A HEALTH PLAN PROPOSAL

to support the Women & Infants Hospital Community

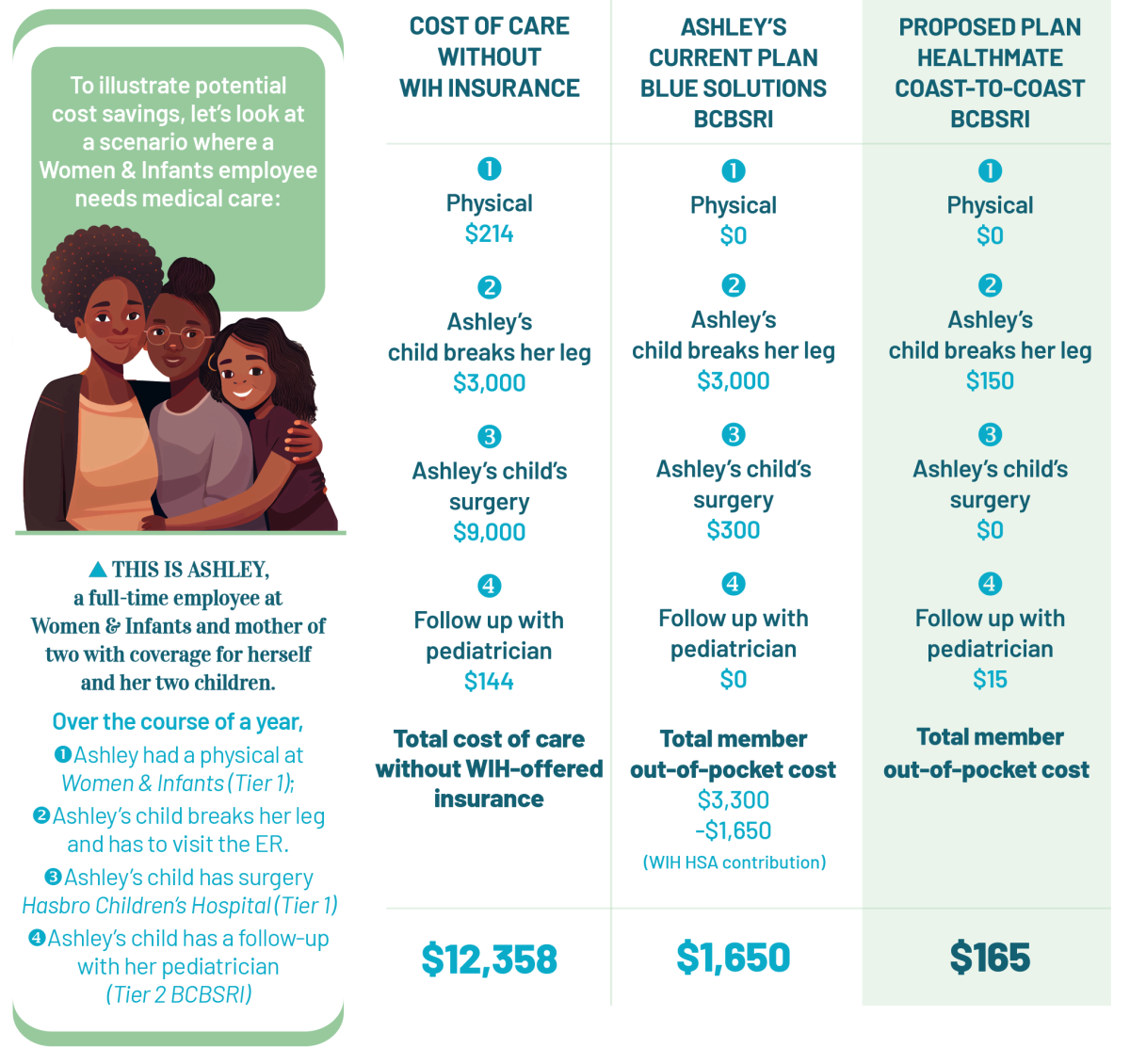

Women and Infants Hospital has put forward a new health plan as part of the contract

negotiations with 1199SEIU. Healthcare costs are rising faster than before—8.5%

nationally in 2024. To ensure the health insurance plans we offer are affordable for

employees and sustainable for the hospital, we asked national experts to bring their

best thinking and create a best-in-class plan with ways for employees to save and

lower upfront costs. Here’s info about that plan: Blue Cross Blue Shield HealthMate

Coast-to-Coast.

THE FACTS ON THE HEALTHMATE PLAN

» Choice of a wide network of providers in state and across the country.

» No deductible when you are within the Care New England network or at Hasbro Children’s. A smaller deductible when seeing any other provider in the Blue Cross Blue Shield network.

» Special discount for labs, high-tech imaging, inpatient and outpatient care with CNE and Hasbro Children’s Hospital.

» Adds two new payroll deduction options that are lower cost than Family Coverage option 1) Employee + Children 2) Employee + Spouse.

» $0 paycheck contribution year 1 for Employee Only and Employee + Children coverage.

» $17 per week premium contribution from paycheck for Employee + Spouse coverage and Family coverage. Much lower employee payment than other hospital systems regional and nationally.

» $0 cost for all medications that are prescribed by a CNE provider and filled at CNE pharmacy (including mail order home delivery).

WHAT’S HAPPENING

Offering a new health plan option that helps employees save on out-of-pocket costs and reduce uncertainty when seeking care

» Women and Infants Union currently has 5 health plan options. Five plans are

confusing for employees and complicated and expensive for WIH to manage.

» Currently, half of the people in the high deductible plan option, called Blue Solutions HSA, are not getting the full benefits of the plan such as making HSA account contributions to pay healthcare costs now and in retirement and realizing tax

advantages. These employees also have a high deductible, creating significant upfront costs for them the moment they need care in the new year.

» Nationally, employees are not selecting high deductible plan options because of this upfront expense and the associated risks.

» For 2026, we are proposing to offer 3 health plan options, including a preferred plan called HealthMate Coast to Coast that offers the broadest BCBS network, includes little to

no upfront costs, small copays and no high deductible.

» The preferred plan offers significant savings over the current plan options.

Learn more about HealthMate Coast-to-Coast

We’re excited to introduce a new health plan developed with input from national experts to help manage rising healthcare costs. This best-in-class plan offers multiple options for savings and lowers upfront costs, making care more accessible and affordable for employees.

- Introduction of a New Health Plan: Learn about a best-in-class health plan designed to help manage rising healthcare costs.

- Multiple Savings Options: Discover how the plan offers various ways for employees to save and reduces upfront costs when seeking care.

- Expert Collaboration: See how national experts contributed to making healthcare more accessible and affordable for you.

Additional industry-standard changes to help us offer this best in class plan

» Those considered part-time for benefits will pay a higher amount of premium than those considered fulltime for benefits.

» Will no longer offer coverage for divorced spouses of employees. This is industry standard and lowers employee tax implications.

» Will no longer offer opt-out credits for medical and dental to those on spouse or parent plans.

» Will no longer offer the Blue Choice New England $250 or the Healthmate $500 plans.

Other Things To Know

» In addition to the Healthmate Plan, WIH will still offer two of the current plans with modifications:

» Blue Solutions plan will include an employee premium contribution, prescription copays and WIH will no longer fund half of the HSA deductible

or provide an option for a front load.

» Blue Choice New England will be a third plan option.

» Anyone who has a balance in their HSA will keep this and can save it to pay for future healthcare expenses, or spend it on plan co-pays, deductibles or other healthcare needs such as sunscreen, glasses, and qualified over the counter products.